February 13, 2026

One of the priorities included in Question 1, the Base Facilities Package, is targeted improvements to Lansing USD 469’s Early Childhood Center. Through the 2024 community pho...

February 11, 2026

One of the most visible signs of deferred maintenance across Lansing USD 469 is the condition of our parking lots. Cracking, uneven surfaces, drainage issues, and repeated patchin...

February 10, 2026

Listening to Our Community One of the clearest messages from our community survey was strong support for expanding Career and Technical Education (CTE) opportunities for student...

February 9, 2026

One of the most common questions Lansing USD 469 hears from the community is, “Why are roofs such a priority in this bond?” The answer is simple but important: many district r...

February 6, 2026

As part of our ongoing Bond Information Series, Lansing USD 469 is addressing questions we are receiving through our online question form and during community presentations. Super...

February 5, 2026

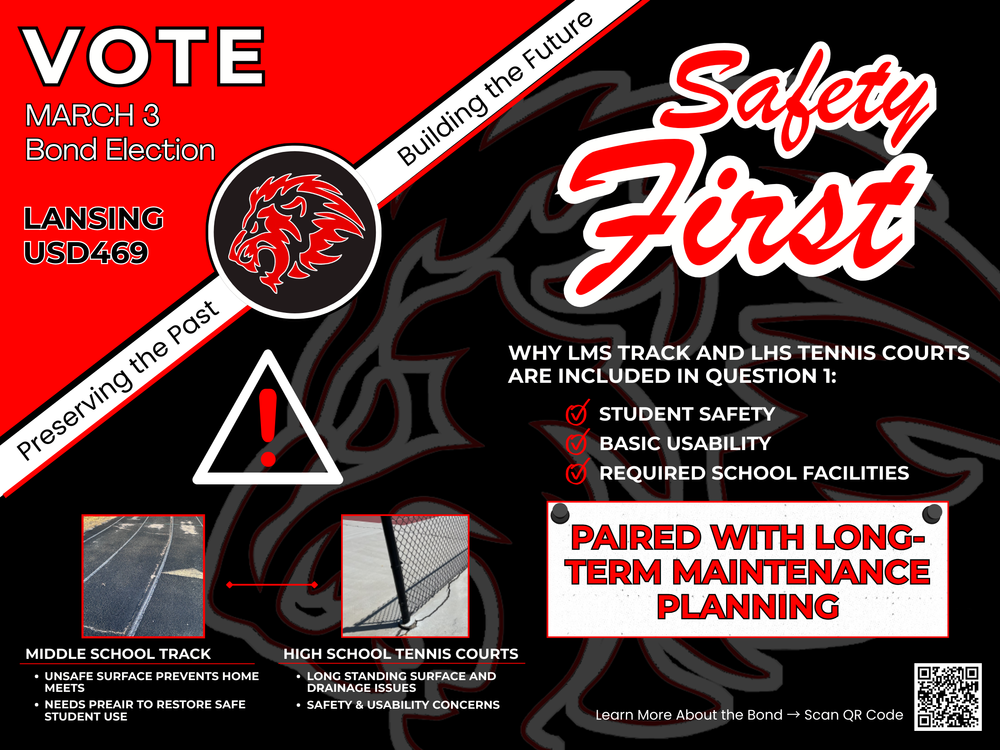

As part of the proposed March 3 bond election, repairs to the middle school track and high school tennis courts are included in Question 1 because they are safety-related facility...

February 5, 2026

Lansing USD 469 is committed to sharing clear, factual information about the proposed March 3 bond election. As part of our ongoing information-sharing efforts, we invite communit...

February 4, 2026

One of the ways the proposed bond helps protect taxpayer investment is through energy-efficient upgrades that reduce long-term operating costs. One example is the district’s plann...

February 3, 2026

One of the most consistent messages we hear from our community is this: “If we invest in our facilities, how will the district ensure they are maintained moving forward?” That qu...

February 2, 2026

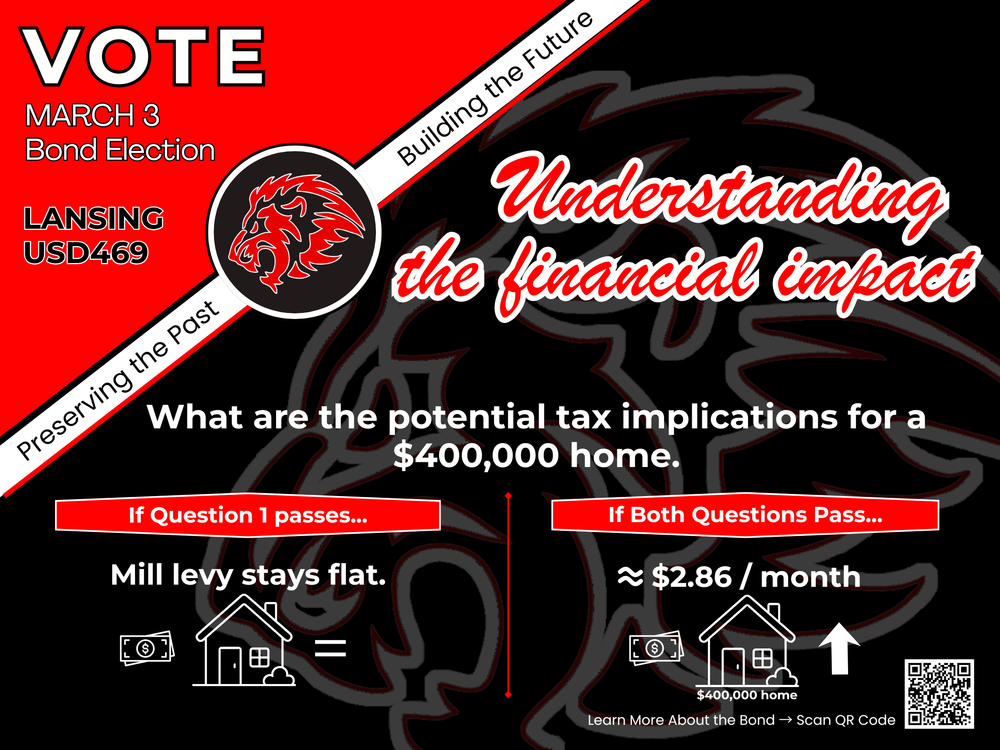

As shared in a previous bond information series post , school bonds are funded through a mill levy, which is applied to a property’s assessed value. Individual tax bills can vary ...

January 30, 2026

Lansing USD 469 is committed to sharing clear, factual information about the proposed bond election scheduled for March 3. To support transparency and accessibility, the distri...

January 29, 2026

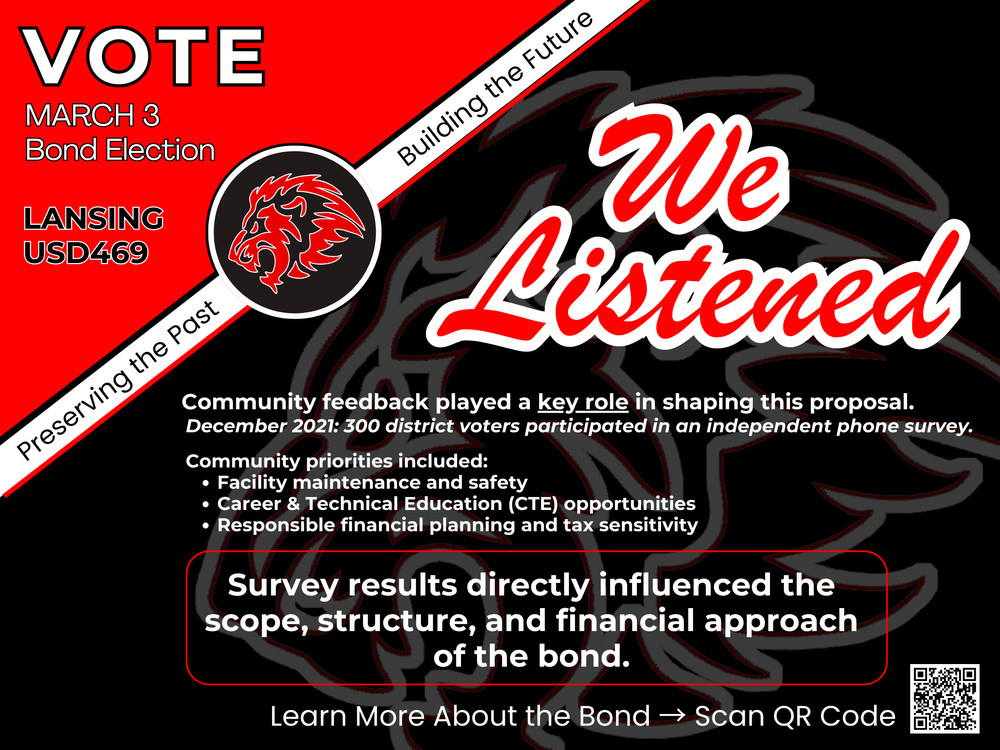

Community input has played a critical role in shaping Lansing USD 469’s proposed bond initiative. Before bringing any proposal forward, the district sought to better understand co...

January 28, 2026

When people talk about school taxes, they often mention something called a mill levy. Understanding how mill levies work can help explain how school bonds impact local taxes. ...

January 27, 2026

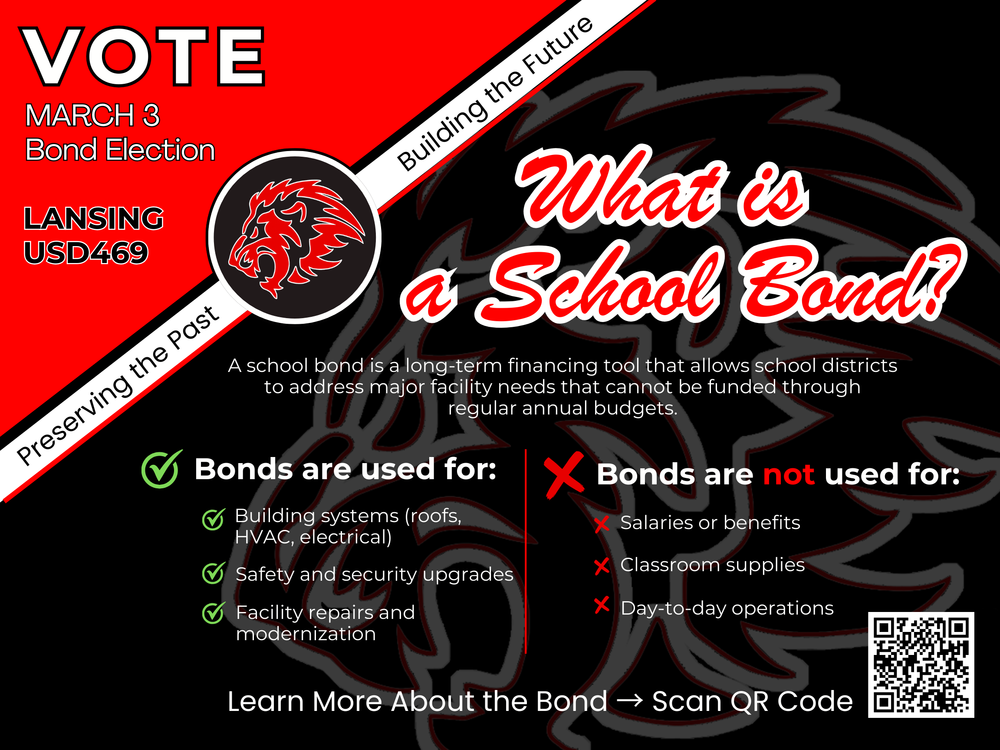

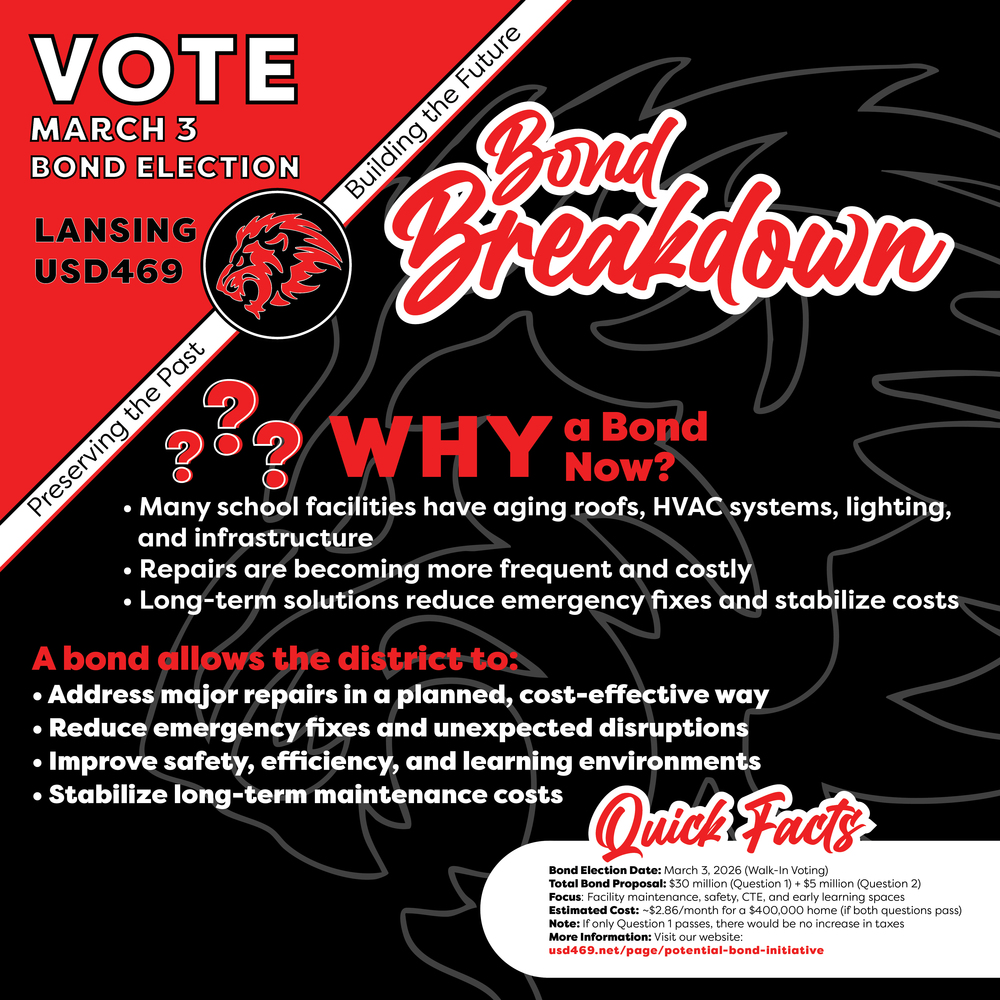

A school bond is a long-term financing tool that allows school districts to address major facility needs that cannot be funded through regular annual budgets. Bonds are used f...

January 26, 2026

Over the coming weeks, Lansing USD 469 will be sharing clear, factual information about the upcoming March 3 bond election. Our goal is simple: to ensure our community has access...